You'll see you have level 1. This type of prototype is also good for demonstrations to stakeholders.

How To Close Fidelity Account Closing Fee 2021

I want to show you how simple invest.

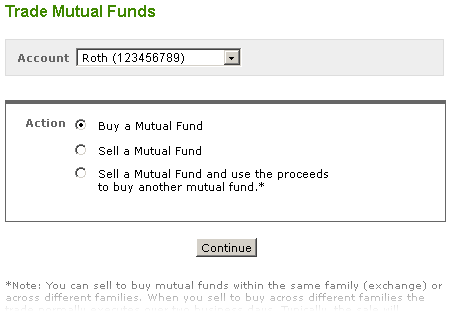

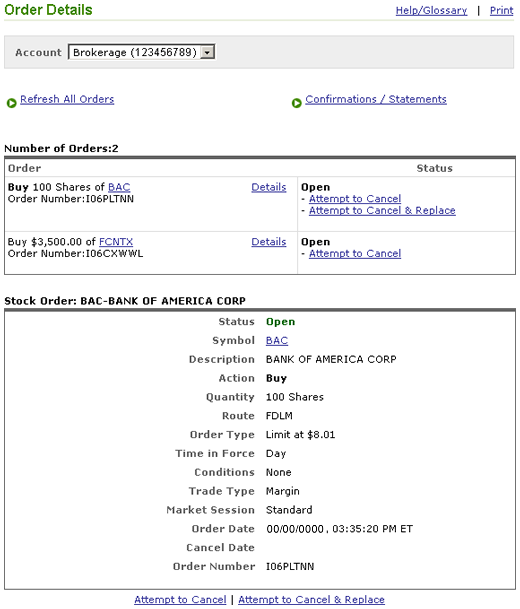

Buy to close fidelity. If you choose this method, you may want to send it certified mail or request a signature at delivery to ensure your letter is received. When the screen is first shown, only open lots are displayed, but you can easily select a tab to change the view from open lots to closed lots. You cannot specify on the close on stop orders, or when selling short.

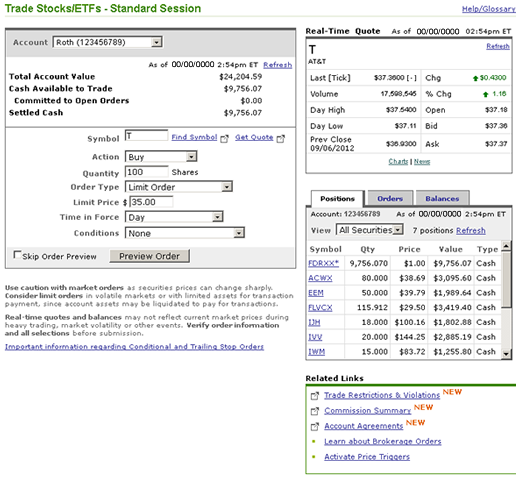

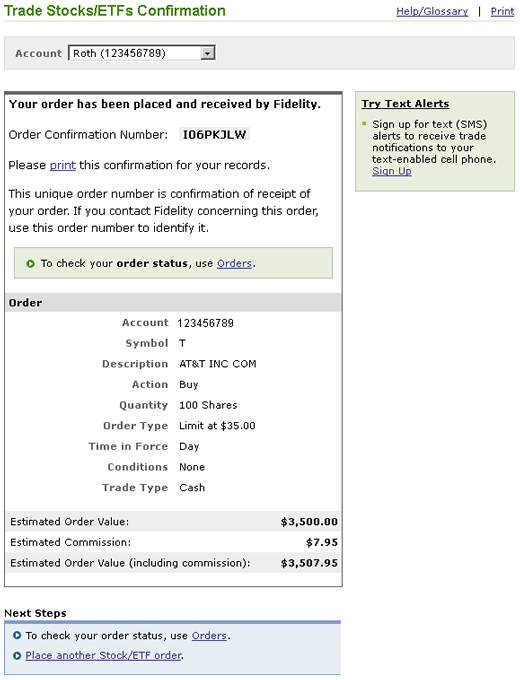

Then you will buy back (buy to close) the short call for $105, and sell (sell to close) the long call for $155. This could be caused by selecting the wrong account or trade type (cash or margin) where the security is held. I sold a pypl put for $5 premium per contract and put a stop loss order for $7.5.

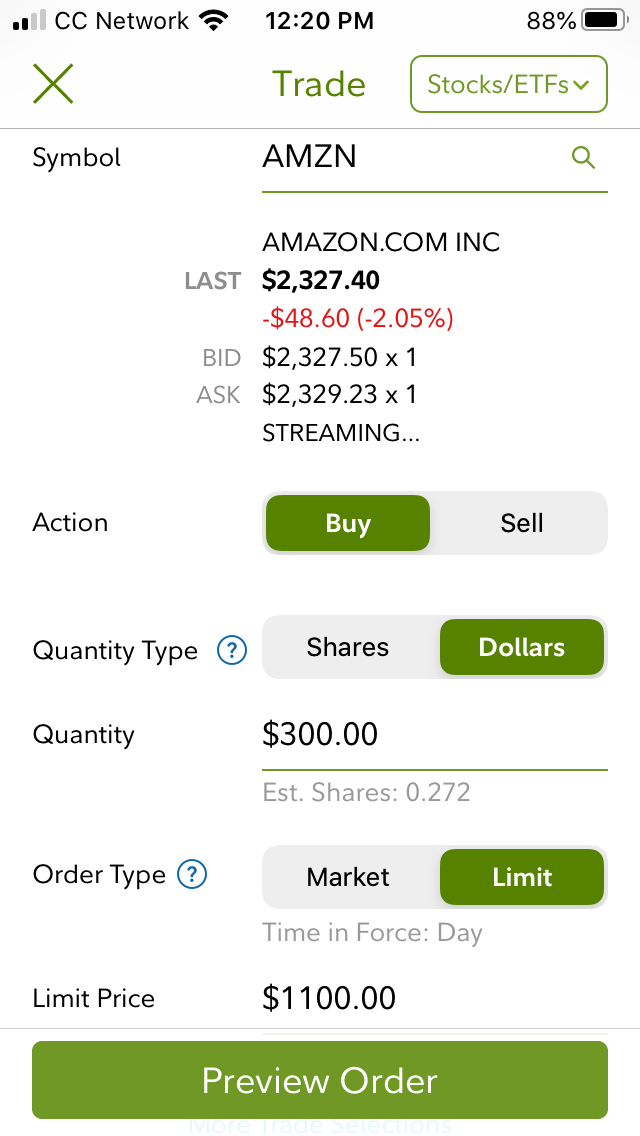

Which would be the ability to sell to open a covered call and buy to close a covered call. Wanting to set up some limit sell orders for my gme shares, but fidelity only lets you set a max price of 50% over the current share price (e.g., if the stock is currently. Shares of fidelity have lost 26.3% over the past six months compared with.

This works the same for both calls and puts. I just noticed buy to close orders of $0.65 or less cost $0. Get yourself to the account features page.

Rolling out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same strike price but with a later expiration date. I kept getting error of 001977 the position you requested to close was not found in the account or trade type selected. And there you'll have an opportunity to apply for the higher level.

You will only see the buy to cover and sell short actions if you are eligible to place these types of orders. Before expiration, close both legs of the trade. When a sell to open order is used on an option, a credit is applied to the traders account.

Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from. Each customer may have a different reason for buying or selling. The fifth method to close an account is to snail mail a written request to the company's physical address:

'buy to close' refers to terminology that traders, primarily option traders, use to exit an existing short position. Nasdaq does not accept on the close orders. 'buy to close' is used when a.

You only have level 1 option approval. This involves closing out your existing options position (by selling to close a long position or buying to close a short position) that is about to expire and simultaneously purchasing a substantially similar options position, only with a later expiration date. Long story short, i try to buy to close but can't seem to do it.

Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange traded products or closed end funds. If a trader wants to short an option, he/she would use a sell to open order. Recent news headlines are as of the date indicated on the full story.

Day orders are good until the premarket or after hours session ends. The only way to unwind a sell to open order is with a buy to close order. Thus, sale of the segment might induce a loss of revenues and unfavorably impact fidelity's financials in the near term.

In today's video, i am going to take you with me as i open an account at fidelity and invest $100 in 5 different stocks. Fidelity buy to close orders of $0.65 or less. You can't place any conditions (such as all or none or do not reduce) on an extended hours trade.

Can't buy to close options because of no settled cash in margin account? Short sales are eligible only from 8:00 am et. You need level 2 for buy to open.

I sell a covered call at a $1 bid, and would like. For example, assume that 55 days ago you initiated a covered call position by buying ttt stock and selling 1 september 35 call. If the option reaches a very low price (worth <15% of the premium) you may just go ahead and buy to close (commission free if <$0.65) to prevent being assigned if there is a sudden spike in stock price.

In this example, your loss is $150: You can place on the close orders for a minimum of 100 shares before 3:40 p.m.

How To Sell Calls And Puts Fidelity

How To Trade Options On Fidelity - Youtube

Trading Faqs Placing Orders - Fidelity

Trading Faqs Placing Orders - Fidelity

Fidelity Acat Fee Fidelity Account Transfer Out Cost 2021

Fidelity Bitcoin Buy Ethereum Dogecoin Crypto-currencies

Fidelity Broker Review 2020 - Warrior Trading

Fidelity Review 2021 - Pros And Cons Uncovered

Trading Faqs Placing Orders - Fidelity

Trading Faqs Placing Orders - Fidelity

Fidelity Review 2021 - Pros And Cons Uncovered

Fidelity Broker Review 2020 - Warrior Trading

Fidelity Extended Hours Trading Pre Market After Hours 2021

How To Transfer Stocks From Robinhood To Fidelity

How To Buy Stock On Fidelity - Youtube

Fidelity Drip Fidelity Dividend Reinvestment Plan 2021

Fidelity Short Selling Stocks How To Sell Short 2021

2

Fidelity Hidden Fees 2021

Buy To Close Fidelity. There are any Buy To Close Fidelity in here.