Purchasing the right amount of home insurance is crucial for your peace of mind. The risk is that you have no cushion if your replacement cost figures are not accurate.

How Much Life Insurance Is Enough Life Insurance Life Insurance

It protects possessions like televisions, furniture, and more.

What does 100 replacement cost mean for insurance. (the other primary valuation method is actual cash value (acv).) Most homeowners think that home replacement cost is the same as a home's market value. This will result in the property being fully repaired, however the cost of labor and materials will be substantially less lowering the amount of coverage.

100% replacement cost means that you have the correct amount of insurance to rebuild the association to the way it was before you had a loss. Replacement cost is the amount of money it would cost to rebuild your home as it was before if it's destroyed, or to purchase brand new items if your old ones are damaged or stolen. In homeowners insurance, replacement cost is the amount it would cost to rebuild your home — or replace stolen or damaged belongings — without deducting depreciation from the claim reimbursement

Replacement cost insurance covers the cost of replacing an item, even if the value of that item increases or the price goes up. Most major home insurance companies offer extended replacement cost at an additional cost — typically an additional $25 to $50 annually, depending on if you go with 25% or 50%. This level of insurance is not included in every policy, and may not be available by all insurers.

This valuation method fully indemnifies the insured without any depreciation and without a maximum reconstruction payment. So, if your insurance policy includes replacement cost coverage for personal property, it should pay to replace your item—even at increased cost. Insure at 100% total insurable value and use 90% coinsurance.

Simply stated, it means the cost to replace the property on the same premises with other property of comparable material and quality used for the same purpose. Providing the replacement cost estimator to anyone outside the agency increases the e&o exposures of the agency. Inform your insurer if you have upgraded or improved your home, because these alterations.

In fact, new cars can lose up to 11% of their value upon purchase. If the vehicle is stolen, replacement cost insurance will reimburse you for 100% of the value of a new car. If you buy a new vehicle, the value of the car drops as soon as you drive it off the lot.

In other words, it is the cost of purchasing a substitute asset for the current asset being used by a company. Replacement cost is the amount of money required to replace an existing asset with an equally valued or similar asset at the current market price. Replacement costs can change over time, so you should review your homeowners policy annually to make sure its coverage meets your needs.

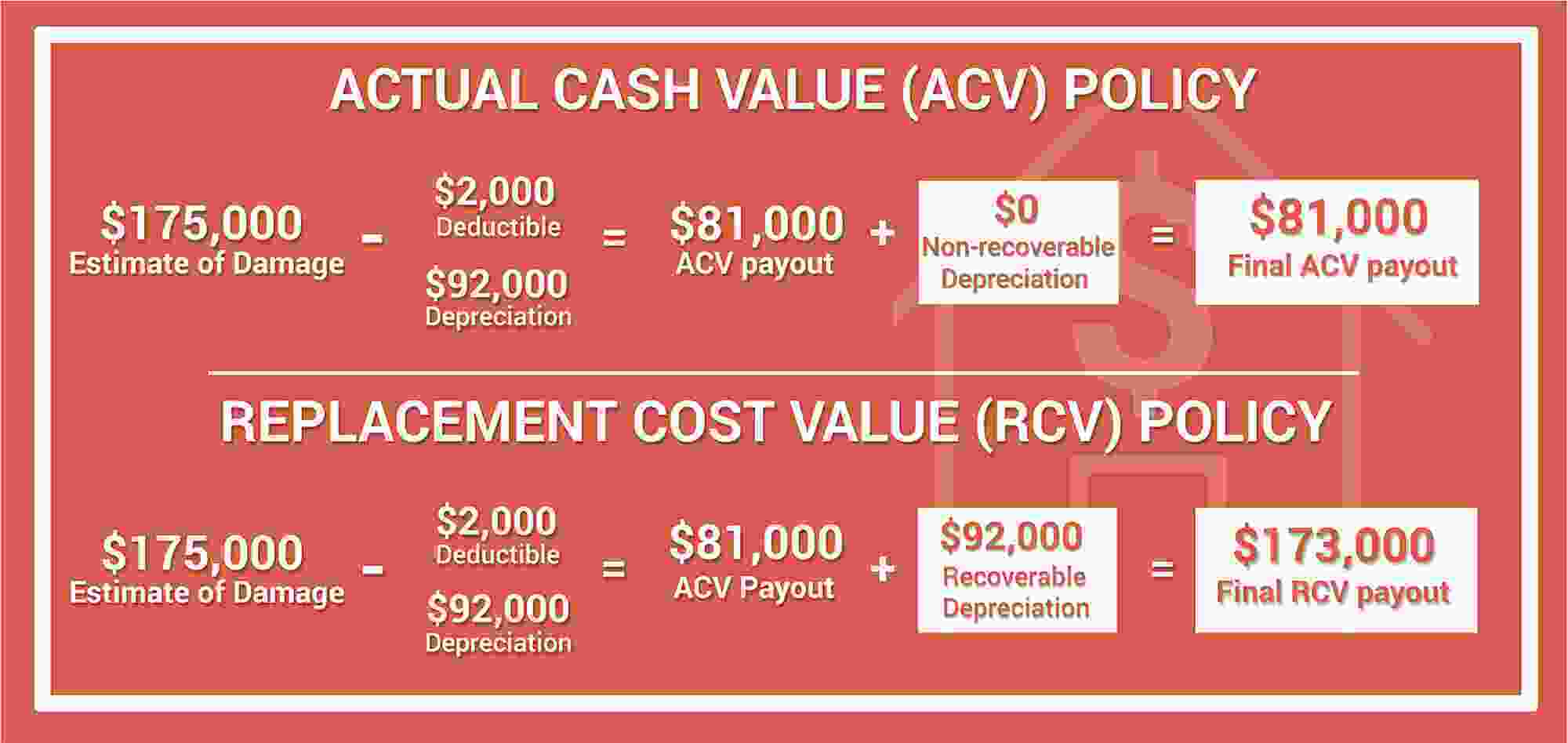

Replacement cost coverage is one of two loss settlement valuation methods that insurance companies use to determine how much you're owed on a claim. Functional replacement cost can be used as a solution in these situations by insuring and, in the event of a loss, rebuilding the property using modern constructions techniques and materials. How insurance covers you if you're below the.

The term "replacement cost" is defined or explained in the policy. Hooker posted an article soliciting it services, replacement or reconstruction cost. (however, if you live in close proximity to the coast or areas prone to natural disasters, your insurer may charge more for this endorsement.)

When real estate markets are appreciating, it can often cost more to buy a resale or used home than to build a new home. What does "replacement cost" mean? One of the most important things to know when buying home insurance is knowing replacement cost insurance.

Requests to provide the replacement cost estimator coupled with a request on the evidence of property insurance for wording such as "100 percent/guaranteed/full replacement. Some insurance companies and policyholders have argued over just what constitutes "replacement cost." The first place to look for answers is in your condominium bylaws.

Replacement cost is the amount of money it may require to replace a structure with a similar type of construction. Replacement cost coverage — a property insurance term that refers to one of the two primary valuation methods for establishing the value of insured property for purposes of determining the amount the insurer will pay in the event of loss. A recent post, insurance agents and determining coverage limits for buildings, generated a number of very interesting comments about the differences between replacement cost value of a building and the reconstruction value of a building.there is a difference between the two values and it is a big issue.

Now, the expense cost varies from year to year, especially if you're looking at the cost to replace a home. Your replacement cost only covers the cost to rebuild your home. For the best protection, experts recommend that you insure your home for at least 100 percent of its estimated replacement cost.

It covers the cost to fully replace your personal property if it is damaged or destroyed by a covered loss. Replacement cost insurance is a coverage option for property insurance policies, especially homeowners insurance. Many bylaws require that you insure the buildings to 100% of the replacement cost.

This applies unless the limit of insurance or the cost actually spent to repair or replace the damaged property is less. A replacement cost is an amount that it would cost to replace an asset of a company at the same or equal value. It pays for the replacement cost of your home and belongings.

Replacement cost insurance is designed to cover the costs of replacing your home and those contents covered under the policy, if they are severely damaged or destroyed. For example, if your leather recliner is destroyed in a covered loss, replacement cost on contents coverage will pay. Guaranteed replacement cost — a property insurance valuation option found in some homeowners policies.

Now, your homeowners insurance policy will only cover 75% of the $50,000 in fire damage, or $37,500. This left a potential gap of $10 million in coverage. Replacement cost on contents offers you extra coverage.

Yes, there is a discount on the rate, but it's better to insure for 100% of the value and use an 80% coinsurance percentage—then you have a 20% cushion. What are the risks of replacement cost? The policy pays the full cost of replacing the home even if this amount exceeds the policy limits.

In the same scenario, if you pick dwelling limits of $120,000, you are covered for 75% of the $160,000 threshold.

Determine Your Home Insurance Coverage With This Replacement Cost Vs Market Value Video Find Out More From State Home Insurance Homeowners Insurance Insurance

Keep An Eye On Your Fluids Automatic Transmission Fluid Brake Fluid Fluid

More Health-related Infographics Healthcare Infographics Infographic Health Health Care

100 Scripts Tips Ch5 How Do You Explain The Benefits Of A Final Expense Policy Or The Benefits Of A Cheape Insurance Sales Final Expense Insurance

Its Very Common That Your Current Employer Will Never Provide You P45 Payslips In Case You Leave The Current Tax Forms Income Tax National Insurance Number

Coast Capital Savings Wants Me To Take Out A Car Loan - The Lifestyle Digs Car Insurance Best Car Insurance Car Loans

Life Insurance Over 70 How To Find The Right Coverage

100 Scripts Tips Ch2 How Do You Handle Common Objections You Get From Telemarketed Leads S Insurance Sales Final Expense Insurance Script

Homeowners Insurance - Downey Ca Los Angeles Ca - The Point Insurance Services Inc Homeowners Insurance Homeowner Content Insurance

Pin On Video Board

Replacement Cost Valuercv Vs Actual Cash Valueacv

Pin On Video Board

Pin By Hanna Hammar On Kukhnya Vdol Okna Coffee Dripper Kitchen Cabinet Colors Wood And Steel

More Health-related Infographics Healthcare Infographics Infographic Health Health Care

Canara Bank Mediclaim - Apollo Munich Easy Group Health Insurance Group Health Insurance Health Insurance Group Health

Aula Magna Di Architettura Roma Tre Architecture Auditorium Campus

Pin On Video Board

63 Fintech Startups Targeting Millennials Fintech Startups Tech Startups Fintech

Is Debt From Student Loans Still Worth A Degree Student Debt Student Debt Relief Online Business Classes

What Does 100 Replacement Cost Mean For Insurance. There are any What Does 100 Replacement Cost Mean For Insurance in here.